Introduction to Changes and Compliance Requirements

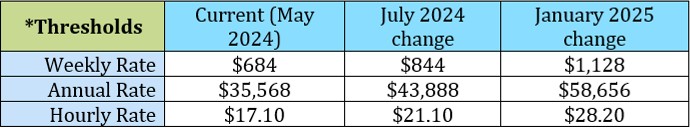

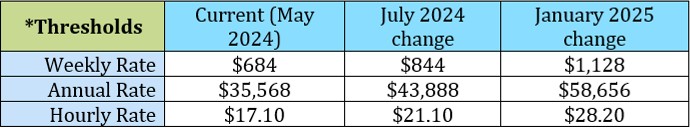

With the announcement of new overtime rules by the U.S. Department of Labor on April 23, 2024, significant changes to the salary thresholds for exempt employees are impending. Effective July 1, 2024, the salary threshold for exemption will increase to $43,888, and will further rise to $58,656 on January 1, 2025. Subsequent adjustments are scheduled every three years, beginning July 1, 2027. These changes necessitate strategic adjustments in an agency's human resources policies to maintain compliance and manage compensation costs effectively.

Proactive Steps for Compliance

- Identification and Adjustment of Employee Status: Agencies must identify employees currently classified as exempt but earning less than the new thresholds. Immediate adjustments in their classification may be needed to comply with the revised salary criteria.

- Overtime Management and Budgeting: Estimating the current overtime work of employees is critical. Each agency should analyze how the new salary threshold will affect overtime eligibility and assess the impact on the budget. This will guide necessary adjustments in compensation strategies to accommodate higher labor costs without significantly disrupting operational efficiency.

- Some Compressed workweek schedules, such as nine, nine-hour days with an additional day off every other week will result in overtime hours during one of those two weeks of a biweekly pay period.

- Job Description Reviews: Agencies should conduct thorough reviews of job descriptions for all exempt positions to ensure that they accurately reflect the responsibilities and criteria under the new rules. This step is essential to defend against misclassification claims and ensure that all employees are fairly compensated according to their roles and duties.

- Uniformity in Employee Classification: It's crucial to ensure that employees in similar roles are classified consistently across the organization to avoid potential discrimination claims. Any discrepancies should be rectified immediately to maintain fairness and transparency in employee treatment.

- Communication and Morale: If changes in FLSA status are made, developing a comprehensive communications plan is vital for managing the transition of employees from exempt to nonexempt status. Clear communication will help minimize confusion and negative impacts on employee morale. This plan should detail the changes, reasons behind them, and benefits to the employees, thus maintaining an open and trusting workplace environment.

- Policy Adjustments on Overtime and Remote Work: In anticipation of increased nonexempt workers, agencies might consider implementing restrictions on overtime to control labor costs. Additionally, revising policies on telecommuting and the use of mobile devices can help curtail overtime and off-the-clock work, ensuring that all employee work hours are properly compensated and recorded.

- Whether nonexempt employees must be paid for their on-call time depends on whether they are "waiting to be engaged" or are "engaged to wait" as defined by the FLSA.

The new FLSA overtime rules represent a significant shift in how agencies must approach employee compensation and classification. By taking proactive steps to identify affected employees, adjust compensation strategies, ensure accurate job descriptions, and maintain clear communication, agencies can seamlessly transition to the new regulations while maintaining operational efficiency and employee satisfaction. Regular policy reviews and adjustments in line with ongoing legal requirements will further solidify the agency’s commitment to compliance and fair labor practices.

Explanation of FLSA Exemptions

The FLSA exemptions to overtime requirements apply to employees who fulfill specific salary and duty criteria under the Executive, Administrative, and Professional categories. These are often referred to as "white-collar" exemptions and do not apply to blue-collar workers or other manual laborers who perform work involving repetitive operations with physical skill and energy.

Below are the three primary exemptions, though others exist. The * indicates that the information is current as of May 2024, but will change in July 2024.

- Executive Exemption

To qualify for the executive employee exemption, all of the following tests must be met:

- The employee must be compensated on a salary basis (as defined in the regulations) at a rate not less than $684* per week;

- The employee’s primary duty must be managing the enterprise, or managing a customarily recognized department or subdivision of the enterprise;

- The employee must customarily and regularly direct the work of at least two or more other full-time employees or their equivalent; and

- The employee must have the authority to hire or fire other employees, or the employee’s suggestions and recommendations as to the hiring, firing, advancement, promotion, or any other change of status of other employees must be given particular weight.

- Administrative Exemption

To qualify for the administrative employee exemption, all of the following tests must be met:

- The employee must be compensated on a salary or fee basis (as defined in the regulations) at a rate not less than $684* per week;

- The employee’s primary duty must be the performance of office or non-manual work directly related to the management or general business operations of the employer or the employer’s customers; and

- The employee’s primary duty includes the exercise of discretion and independent judgment with respect to matters of significance.

- Professional Exemption

To qualify for the learned professional employee exemption, all of the following tests must be met:

- The employee must be compensated on a salary or fee basis (as defined in the regulations) at a rate not less than $684* per week;

- The employee’s primary duty must be the performance of work requiring advanced knowledge, defined as work which is predominantly intellectual in character, and which includes work requiring the consistent exercise of discretion and judgment;

- The advanced knowledge must be in a field of science or learning; and

- Advanced knowledge must be customarily acquired by a prolonged course of specialized intellectual instruction.

Handling Dual Job Roles

If an employee holds more than one position within their agency, their FLSA classification is determined by the combination of duties across all roles. If the combined duties qualify the employee for exempt status, the agency must continue to pay at least the minimum salary without requiring overtime for additional hours worked in the secondary role. However, if the combined duties qualify the employee for non-exempt status, overtime must be paid according to federal and possibly more stringent state laws.

For additional detailed guidance, refer to the U.S. Department of Labor's resources on FLSA exemptions and compliance:

Fair Labor Standards Act (FLSA):

Society of Human Resource Management: